EARLY WARNING SYSTEM

Measure, monitor and mitigate industry risk with forward looking trends

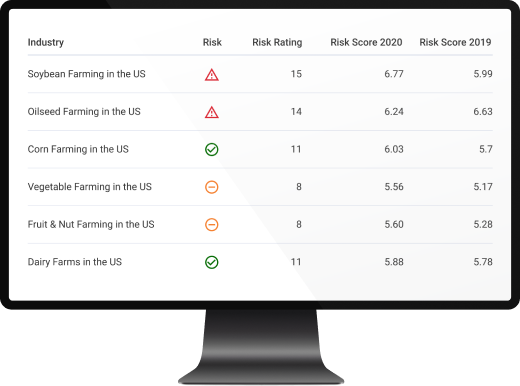

Using our forward-looking trends, commercial banks use the EWS to identify opportunities and monitor risks across the economy at the industry level. EWS will help you understand both the direction and magnitude of risk changes

DOWNLOAD BROCHUREFEATURES OVERVIEW

Features of Â鶹Çř's Early Warning System

-

Exclusive forward-looking trends

-

Quarterly service delivered via Excel

-

Identifies industries that fall in low, medium and high risk categories

-

Flags industries that are rapidly moving toward another risk category

-

Risk rating scale ranges from 1-9

-

Scores roll-up to 2-digit NAICS classification and are available for the whole collection of US NAICS industries

-

Scores mapped to OCC sectors and groups

FEATURES

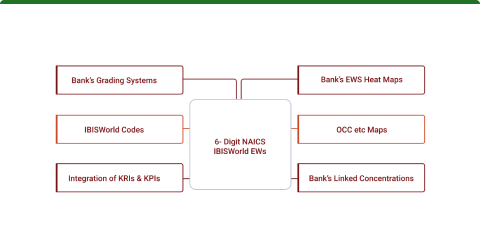

Map to internal systems

Â鶹Çř’s industry code mappings connect our risk data to your internal credit rating systems and integrate our key risk indicators (KRIs) with your key performance indicators (KPIs).

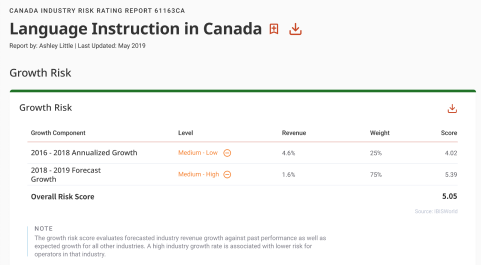

RISK RATINGS REPORT

Value add for credit risk professionals

Â鶹Çř’s Industry Risk Rating reports analyze data that determine an industry’s risk rating, while the value-add EWS provides additional insight into how risk scores are changing over time.

LEARN MORE

IBISWORLD CLIENTS

Who Uses Â鶹Çř Industry Early Warning System?

Underwriters

Risk Departments

Credit Departments

IBISWORLD INDUSTRY INSIDER

Related Articles

Membership

When you become a member of the Â鶹Çř community, you get instant access to our full suite of reports, along with a dedicated client relationship manager to help you get the most out of your membership. Contact us to learn about discounts we can offer your organization.

Learn More